Goods from abroad

Only a Customs Agent may carry out the procedure for the transfer and receipt of goods. Once the goods are transferred to our CORFERIAS Free Trade Zone, they will remain in the warehouses until the following

procedure is carried out for their display:

- Release of transport documentation.

- Pre-inspection of goods

- Performance of the receipt process through the goods receipt form in the Foreign Trade Warehouse. For this procedure, CORFERIAS will enable a username and access code for the Customs Agency chosen by the exhibitor so that he/she can enter the system.

- Goods checked by customs

- Delivery of goods to be displayed, to the exhibitor or his Customs Agent.

- Conditions for the receipt of goods from abroad

For the receipt of goods in the foreign trade warehouse at CORFERIAS, exhibitors must take the following considerations into account:

GENERAL CONSIDERATIONS:

- CORFERIAS only allows the entry of goods that are linked directly to the event.

- In order to facilitate the participation of exhibitors in the event, it is suggested that the goods be exhibited in their entirety, otherwise they will remain in the Foreign Trade warehouse of CORFERIAS and will be charged for the duration of their storage.

- The exhibitor, his representative or hired Customs Agent, are responsible for the legality and proper handling of the goods and must be held accountable for customs requirements by CORFERIAS as Operator and User, or the tax authority (DIAN).

- Any and all expenses incurred by the handling of goods within the Special Permanent Free Zone shall be covered by the exhibitor or its authorized Customs Agent.

- It is important to verify the tariff position of the goods before their dispatch so it can be determined whether they require clearance, certificates of origin, permits, restrictions, etc., which must be completed, in order to prepare for the requirements needed by Customs in Colombia.

- Goods may be received from abroad until the last day of the event, i.e., February 27, 2026.

- Merchandise from abroad may enter via the ports authorized by the DIAN (Barranquilla, Cartagena, Buenaventura, Santa Marta) with the DTA (Customs Transit Declaration) or the Journey Continuation Document as supporting documents. On the other hand, if the goods enter via the border with Venezuela and/or Ecuador, they must be accompanied by the DTAC (Declaration of Customs Transit by Road) as support. Goods arriving by air may also enter through authorized airports.

- The exhibitor must take into account that goods may only be nationalized by a physical person or legal entity with a citizenship card or Tax ID Number issued by the Republic of Colombia to support the due importation process.

- Please take note of the endorsement conditions for the transportation document.

- In accordance with existing Colombian legislation, the entry of goods as baggage is not permitted, therefore, the exhibitor must change the classification in the declaration form and submit it to the Tax Authority (DIAN) at the airport upon arrival in the country.

- This is due to the fact that the CORFERIAS Special Permanent Free Trade Zone cannot receive goods that are not legalized by customs, and they may be apprehended by the Tax Authority (DIAN). The exhibitor may be held accountable by the DIAN if he/she decides to bring in his goods using this method, under any circumstances.

GOODS FOR SALE IN RETAIL

- Any goods that enter from abroad to be sold at fairs where retail purchases are allowed, must be nationalized beforehand. The Foreign Trade Office will not deliver any goods that have entered the CORFERIAS Free Trade Zone if they do not comply with this procedure.

- Exhibitors under the Standard Regime (Régimen Común) must provide invoices for the sale of their goods and collect the applicable VAT. Being in the Special Permanent Free Trade Zone of CORFERIAS does not mean they are exempt from this duty.

Dwell time of goods in the Free Trade Zone

At the end of the event, the exhibitor’s goods may remain in warehouses of CORFERIAS at no cost up to six (6) days after the event has finished. As of the 7th, exhibitors that still have goods inside CORFERIAS’ warehouse must pay the rate established for the current year in Colombian pesos/ per kilo/ per day. In the event that the merchandise is nationalized and withdrawn before the start date of the showcase, it will be charged from the moment the merchandise enters the Free Trade Zone according to the rate established for this purpose, which may be consulted at the CORFERIAS Foreign Trade office.

Goods Receipt Forms

*Note: The forms are free of charge and their completion is mandatory for each exhibiting

company.

FORM No. 1: Receipt of goods from abroad and/or goods transferred from Free Trade Zones.

a. For the receipt of goods from abroad:

This form can only be completed by the Customs Agent and applies to goods from abroad that have not

been nationalized. It protects all the goods that are going to be exhibited during the event with the option of nationalizing, re-shipping or transferring the goods to an industrial user in another free zone once the event ends.

Supporting documents required for these types of goods are: a sales invoice (in Spanish, containing a

detailed description of the goods) in the name of the exhibitor or his representative in Colombia; a packing list and transport document (air waybill, BL, journey continuation document or a DTAI) – the tariff positionmust be specified.

b. Transferring goods from one free trade zone to another

This form can only be completed by the Customs Agent and covers goods transferred from one free zone

to another, whether they are industrial goods and services FTZs or transit FTZs. The following supporting

documents must be attached: sales invoice (in Spanish) in the name of the exhibitor or their

representative in Colombia, packing list and transport document (air waybill, BL, journey continuation

document or DTAI), as well as the transfer authorization issued by the DIAN if it is from the same

jurisdiction, or DTA if it is from another jurisdiction.

FORM No. 2: Receipt of nationalized merchandise

This form may be completed directly by the exhibitor and is used for the receipt of nationalized goods, i.e., goods that are freely available in the national customs territory. It is essential to attach a photocopy of the 26 final customs declaration if you are an importer, or a sales invoice if you are a distributor. These supporting documents must be delivered to the Foreign Trade office of the PLUS platform before the start of the event.

Any nationalized goods will enter the stand directly for exhibition on authorized assembly days.

The information provided by the exhibitor must be clear and fully supported by the import declarations or invoices submitted as supporting documents. The exhibitor is responsible for the information contained therein and will be liable before the DIAN tax authority for any errors in the processing and completion of the forms.

FORM No. 3: Receipt of domestic goods

This form can be completed directly by the exhibitor and applies to the receipt of national merchandise, i.e., goods that are prepared, produced or made in Colombia. Annexes are not required. Any goods entering for exhibition or goods used for the assembly of the stand must be listed in the form clearly and in full.

Domestic goods will enter the stand directly for exhibition on the days authorized for assembly. The exhibitor will be liable to the DIAN for all the information provided.

** For more information see instructions for the receipt of national and nationalized goods on the website**

FORM No. 4: Receipt of samples with no commercial value.

This form can only be completed by the Customs Agent and applies to goods with no commercial value,

from abroad consigned to the fair. It safeguards the material that is going to be distributed, consumed or tasted throughout the exhibition.

For items from abroad that are imported for consumption, distribution or use considered samples of no

commercial value, the text in the invoices must effectively state that they are samples of no commercial

value, for free distribution and use. For customs-related purposes they should not exceed the amount

authorized by the DIAN. Furthermore, no currency transfers shall be made to the country of origin in the

amount at hand.

This form must be accompanied by the following supporting documents: sales invoice (in Spanish, containing a detailed description of the merchandise and a note stating that it is a sample of no commercial value) in the name of the exhibitor or their representative in Colombia, the packing list and transport document (air waybill, BL, journey continuation or DTAI, the tariff position must also be specified).

waybill, BL, journey continuation or DTAI, the tariff position must also be specified).

In order to authorize the entry of food and liquor as samples of no commercial value to the Free Trade Zone, the supporting legal documents from the country of origin must be submitted (health records, approval certificates for consumption, permits, etc.).

Likewise, it is very important for the exhibitor take into account that this material must be marked as a

SAMPLE OF NO COMMERCIAL VALUE and must be consumed in its entirety within the Free Trade Zone.

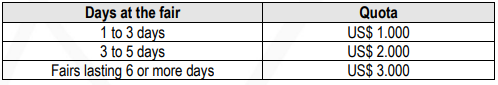

Quotas authorized by the DIAN for samples of no commercial value: